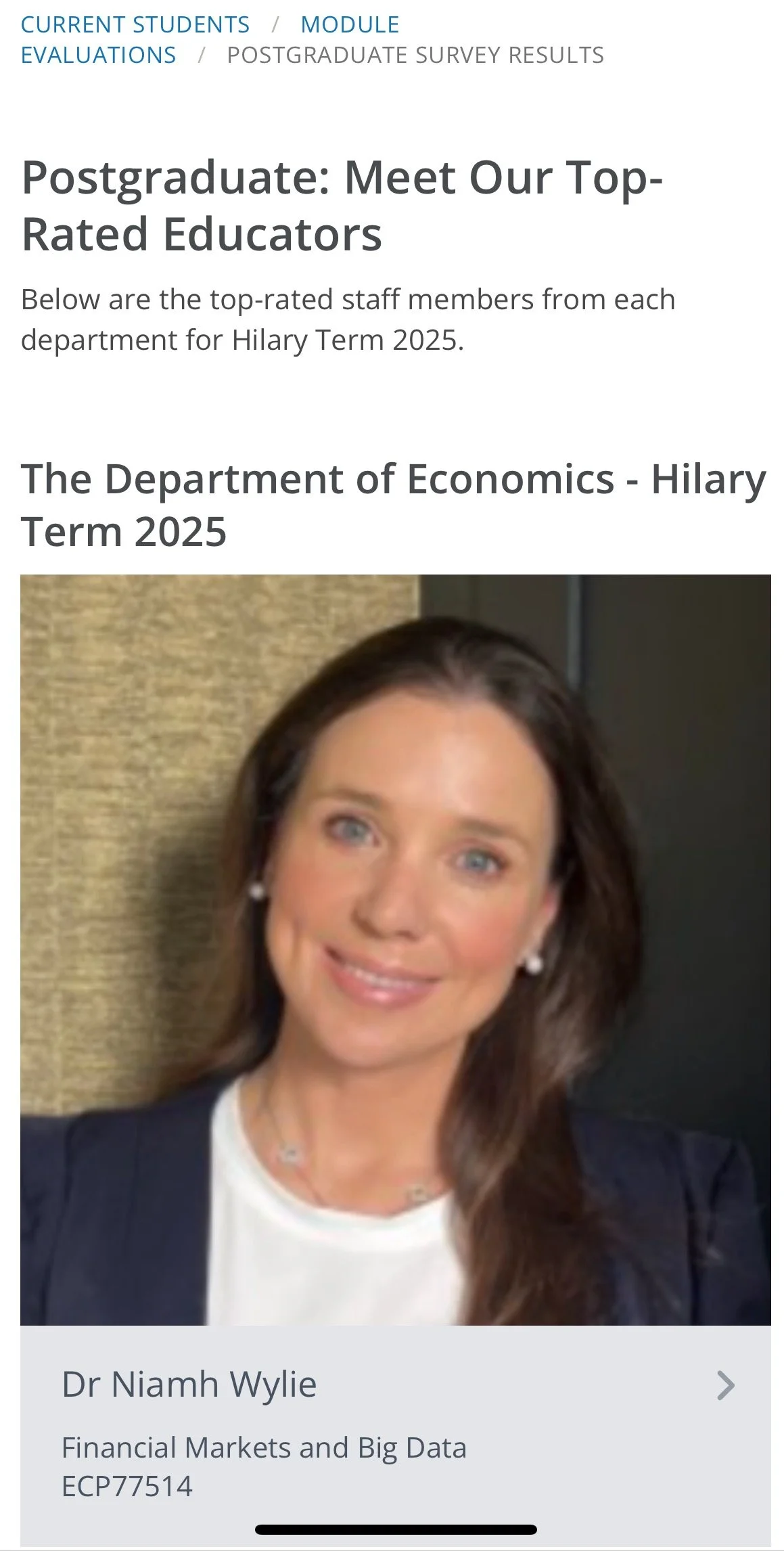

Academic in Finance and Economics bridging industry expertise with research and teaching excellence.

I am an investment professional turned academic, with 15 years experience working in the financial industry, and a proven ability to translate complex concepts into simplified terms. While my background discipline is actuarial mathematics, I have worked for most of my career in trading, derivative and investment roles. This included transacting futures, currency forwards, equity derivatives, interest rate swaps, options and option hedging strategies, and later working on a multi-billion discretionary investment portfolio at Coutts, London.

During my career I have run derivatives workshops, teaching about complex derivative instruments to colleagues, wealth managers and clients. After 15 years in the banking industry, I became interested in the areas of fintech and disruptive technologies, and the intersection with unconventional monetary policies, which led to my Ph.D. studies.

I have been a guest speaker, TA and lecturer at Trinity College Dublin since 2017 in the subjects of Derivatives, Investment Analysis, Asset Allocation, Investments, Introduction to Finance, and Fixed Income and Alternative Investments. For three years I ran the Derivatives module for Senior Sophister Undergraduates at Trinity Business School, and more recently the Financial Econometrics module at Master’s level. Through education, I hope to empower and inspire young people to pursue their dreams and realise their potential.

In 2024, I completed my Ph.D. in International Finance at Trinity Business School, investigating the relationship between unconventional monetary policy and cryptocurrency. My empirical analysis involved various econometric techniques, including Multivariate OLS, Vector-Autoregression, ARIMAX, Auto-Regressive Distributive Lag (ARDL) modelling and Machine Learning Sentiment Analysis using Python.

Most recently, I was an Assistant Professor at TCD Economics, in the area of Applied Economics and Big Data, where I designed and taught two new courses, 'Machine Learning for Economists' and ‘Financial Markets and Big Data’. Applied labs included: Random Forest to analyse equity market beta and nonlinear risk exposure | RNN and LSTM models for asset price prediction | Clustering techniques for Treasury yield curve analysis | Binary Logistic regression for corporate bond default prediction | Python-based pricing of forwards, swaps and options | Detection of mispriced options using Black-Scholes vs. market prices.

My research interests include behavioural economics, unconventional monetary policy and societal / financial market transmission, sentiment analysis, CBDCs, cryptocurrency, and fostering public trust in institutions. Education and research are my passions, and with a unique blend of industry and academic experience, I enjoy helping others learn about the sophisticated world of finance from a practical, theoretical and intuitive perspective.